Samsung financing has become an increasingly popular way for consumers to purchase Samsung products, especially high-end smartphones and appliances. However, there is some controversy around how Samsung financing impacts credit scores and whether it is ultimately beneficial or harmful for consumers. This article will provide an in-depth look at Samsung financing, how it works, its relationship with FICO credit scores, and tips for consumers considering this financing option.

What is Samsung Financing?

Samsung financing allows customers to finance new Samsung products interest-free through monthly payments over a set period of time, typically 12, 18, or 24 months. It functions similarly to a credit card, but is exclusively for Samsung purchases.

Some key things to know about Samsung financing:

- Offered directly through Samsung for their products only

- Requires a credit check and approval

- No interest charges as long as balance paid on time

- Monthly payments are fixed based on total cost and loan term

- Can be used on phones, tablets, watches, TVs, appliances, etc.

Samsung partners with TD Bank to provide financing services. TD Bank is responsible for approving applications, servicing accounts, and reporting payment history to the credit bureaus.

How Does the Samsung Financing Credit Check Work?

When you apply for Samsung financing, TD Bank will perform a hard credit inquiry just like with any other credit application. This means your credit report is accessed and your credit score may temporarily decrease from the hard inquiry.

The credit check will determine your interest rate, which for Samsung financing is almost always 0% APR as long as payments are made on time. Those with excellent credit in the 720+ score range are most likely to qualify for 0% interest.

It’s important to note credit history, income, and existing debt levels are also considered in the approval decision. Those with limited credit history or low credit scores below 650 may not be approved at all.

Can Samsung Financing Hurt Your Credit?

In general, responsibly using credit and making on-time payments will build your credit over time. However, Samsung financing has developed a reputation for hurting credit scores in some cases. Here are a few key reasons why:

- High credit utilization – If approved for a large credit limit, your utilization ratio may spike and lower credit scores. Try to only finance what you can reasonably afford to pay off monthly.

- Account closure – After paying off the balance, Samsung financing accounts are closed. This can decrease your total available credit and also the average age of credit history, both of which can lower scores.

- Late or missed payments – Just like any credit account, late or missed payments will be reported to the credit bureaus and damage your credit. Set up autopay if possible to avoid issues.

- Hard inquiries – Each new application results in a hard inquiry, which can gradually lower your scores if applied for financing too frequently. Limit applications to when you have a legitimate need.

- Pre-qualification is not a guarantee – Getting pre-qualified doesn’t guarantee you will be approved later. Too many pre-qualifications can needlessly add hard inquiries.

As long as you make payments on time, keep balances low, and use Samsung financing sparingly, it is possible to avoid credit damage. However, you must be responsible with the account.

Tips for Using Samsung Financing Without Hurting Your Credit

If you want to use Samsung financing but are worried about impacts to your credit, here are some tips to maintain your scores:

- Check credit reports and scores – Review your credit reports and FICO scores to understand your starting point before applying for Samsung financing.

- Limit financing amount – Only finance as much as you can reasonably afford to pay off monthly to keep credit utilization low. Don’t max out the credit limit.

- Set a monthly budget – Determine what Samsung monthly payment you can manage along with your other expenses without overextending yourself financially.

- Use autopay – Set up autopay through your bank account to ensure you never miss a payment due to forgetfulness. This protects your credit.

- Pay off balance early – Consider paying off the balance a few months early if possible to limit the credit impacts. You can make extra payments without penalty.

- Space out financing – Only open a new Samsung financing account once your previous one is fully paid off and closed. Too many new accounts at once can lower your scores.

- Limit hard inquiries – Be judicious about when you apply for financing and avoid unnecessary pre-qualifications to limit hard inquiries.

Following these best practices can help you use Samsung financing to your advantage without short-term or long-term damage to your credit. Monitor your credit regularly and make adjustments as needed.

The Samsung and FICO Partnership

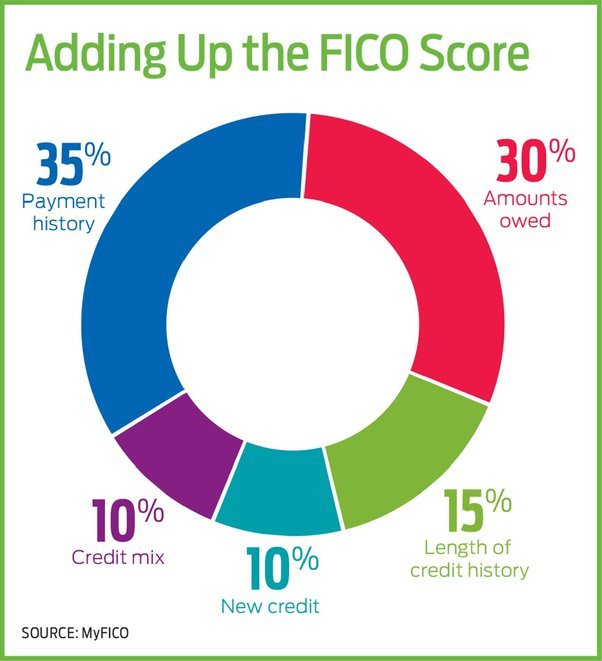

In 2019, Samsung announced a partnership directly with FICO to integrate FICO® Scores into Samsung Pay. This allows Samsung device owners to access their latest FICO Score for free right in the Samsung Pay app along with tips for improving their credit.

This unique partnership provides a few key benefits:

- Easy access to FICO Scores – Samsung Pay users can check their real FICO Score regularly since it updates monthly.

- Credit education – The app provides education on what impacts FICO Scores and how to build credit responsibly.

- Money management – Features like Samsung Rewards and Samsung Pay Cash allow users to better understand spending habits.

- Financial account aggregation – Users can link bank accounts and credit cards to Samsung Pay to manage finances in one place.

For Samsung, offering free access to FICO Scores builds brand loyalty and gives them a competitive edge. For FICO, it helps them reach more consumers directly with their credit scoring products and education.

Should You Use Samsung Financing?

Here are some key pros and cons to consider when deciding if Samsung financing is right for your needs:

Pros

- 0% interest rates with good credit

- Fixed monthly payments

- Can make high-end tech more affordable

- Designed specifically for Samsung products

Cons

- Credit check required

- Can increase credit utilization

- Account closure can lower score

- Missed payments hurt credit

- Pre-qualification not a guarantee

In general, Samsung financing can be a reasonable option for financing a new smartphone or other Samsung product as long as you make payments responsibly, keep balances low, and monitor your credit. However, it is not recommended for those with poor credit or limited income.

Be sure to carefully consider your budget, credit standing, and financing needs before applying. And if you do use Samsung financing, take steps to mitigate risks to your credit scores.

Conclusion

Samsung financing allows customers to purchase Samsung devices and products by spreading costs into monthly payments. While its 0% interest rates are attractive, it can damage credit if not managed prudently. By monitoring credit reports, limiting financing amounts, making payments on time, and paying off balances early, consumers can take advantage of Samsung financing offers without hurting their FICO Scores. Using Samsung Pay and other Samsung products provides convenient access to your latest FICO Score and credit education tips directly from the source. Evaluate your personal situation carefully to determine if Samsung financing aligns with your budget and credit-building goals.

How Does Samsung Financing Work for Purchasing Phones and TVs?

Samsung offers phone financing options that make it easier for customers to purchase their desired phones and TVs. With samsung phone financing options, you can choose from various payment plans and terms to find one that suits your budget. This allows you to enjoy the latest devices without straining your finances. Whether you’re looking to upgrade your phone or enhance your home entertainment with a new TV, Samsung makes it simple and affordable with their flexible financing options.

Samsung Financing and FICO FAQ

What is Samsung Financing?

Samsung Financing is a program offered by Samsung in partnership with TD Bank. It allows customers to finance their purchases of Samsung products using a line of credit.

How does Samsung Financing affect my credit score?

When you apply for Samsung Financing, a hard credit check is performed by TD Bank. This check can temporarily lower your credit score by a few points. However, if you use Samsung Financing responsibly and make your payments on time, it can also help improve your credit score over time.

What credit score is needed to apply for Samsung Financing?

The specific credit score requirement for Samsung Financing may vary, but generally, a good credit score is needed to qualify. It is recommended to have a FICO score of at least 670 or higher for a higher chance of approval.

How do I apply for Samsung Financing?

To apply for Samsung Financing, you can visit the nearest select Samsung store and ask for assistance. The store staff will guide you through the application process. Alternatively, you can apply for Samsung credit online through the Samsung website.

Can I use Samsung Financing to purchase any Samsung product?

Yes, you can use Samsung Financing to finance your purchase of any eligible Samsung product. Whether you’re buying a smartphone, TV, or any other Samsung device, you can choose Samsung Financing during the checkout process.

Does Samsung Financing have a credit limit?

Yes, Samsung Financing provides a credit line which determines the maximum amount you can finance through the program. The credit limit is based on your creditworthiness and other factors considered by TD Bank.

How does Samsung Financing work with TD Bank?

Samsung Financing is issued by TD Bank, and TD Bank manages the program accounts. This means that your payments and account management will be handled through TD Bank’s systems and platforms.

Will using Samsung Financing affect my credit score each time I make a purchase?

No, using Samsung Financing for your purchases does not directly impact your credit score every time. However, if you are consistently utilizing your credit line and carrying a high balance, it could potentially have an effect on your credit score. It is important to always make your payments on time and keep your credit utilization low.

Citations:

[1] https://ficoforums.myfico.com/t5/General-Credit-Topics/samsung-financing/td-p/5652833

Leave a Reply