Buy now, pay later (BNPL) services like Klarna, Afterpay, and Affirm have exploded in popularity recently. These installment plans allow shoppers to split purchases into multiple interest-free payments over time. While BNPL services provide convenience and flexibility at checkout, they also come with some downsides that consumers should be aware of.

How Buy Now, Pay Later Services Work

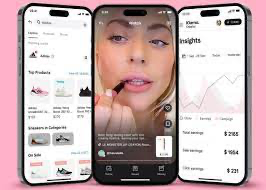

BNPL services partner with retailers to offer installment plans at checkout. Instead of paying for the full purchase upfront, shoppers can elect to split the total into biweekly or monthly payments over 6 weeks to 6 months. Popular providers like Klarna and Afterpay typically divide payments into 4 installments without charging interest or fees.

To use BNPL financing, shoppers go through a soft credit check during checkout that takes seconds to approve. If approved, they simply enter their payment details and agree to the repayment schedule. The BNPL provider fronts the full amount to the retailer immediately so the shopper receives their items right away.

The Main Benefits of Using BNPL Services

BNPL plans have exploded in popularity among younger demographics like millennials and Gen Z. Here are some of the main benefits driving adoption of these alternative financing options:

- Convenience and instant approval – With just a few clicks at checkout, shoppers can split purchases into multiple installments and receive instant approval. This is much faster than applying for a credit card or loan.

- Accessibility – BNPL services use soft credit checks that have minimal impact on credit scores. This allows access to financing for those with limited credit history or low credit scores. Services are also available in-store, not just online.

- Flexibility – Shoppers aren’t locked into long financing terms. BNPL plans are typically 3-6 months so balances are paid quickly. Shoppers can also pay off the full balance early with no penalties.

- Avoid interest and fees – As long as payments are made on time, BNPL plans are interest-free with no hidden fees. This makes them an affordable financing option.

- Budgeting – The installment plans allow shoppers to spread out payments to better align with their budget and cash flow. This can prevent overspending.

- Consumer protection – BNPL services must follow consumer protection laws and regulations around lending disclosures and practices.

The Potential Downsides of BNPL Services

While BNPL plans can provide flexibility and convenience, there are also some risks and downsides for consumers to be aware of:

It Can Lead to Overspending

The ease of splitting payments into multiple installments makes it tempting to buy more than planned. Shoppers may overestimate what they can realistically afford when payments are spread out over time. The instant approvals also feed into impulse purchases without taking time to consider the impact on their budget.

Research shows those who use BNPL services spend 30-50% more than those who don’t. It’s important to be very intentional about each purchase and avoid the mindset of “I’ll just pay it off later.” Overspending can quickly snowball into unmanageable debt.

Late Fees Add Up Fast

While BNPL plans themselves are interest-free, most providers charge hefty late fees between $7-$10 per missed installment payment. These fees add up quickly, especially if you miss multiple payments on several purchases. Late fees essentially act as interest charges.

Before opting into a BNPL plan, be sure you can realistically afford the installment amounts when they are due. Set payment reminders and budget accordingly so you don’t get stuck with expensive late fees.

It Can Hurt Your Credit if Mismanaged

While BNPL services only do a soft credit check initially, missed payments are reported to credit bureaus and can negatively impact your credit score. Defaulting on a BNPL plan is the same as defaulting on any other loan.

Too many hard checks from applying for credit to pay off BNPL balances can also ding your credit. To avoid damage, only use BNPL for amounts you know for sure you can pay off on time.

Lack of Financial Planning

The ease of BNPL plans allows shoppers to purchase now and think about budgeting later. But this mindset prevents proactive financial planning. Ideally purchases should be planned for by saving up or budgeting in advance.

BNPL plans can be helpful but should be used sparingly. Don’t let their convenience promote lack of financial discipline and intentionality with spending.

Easy to Lose Track of Payments

When you have multiple BNPL plans open across retailers, it’s easy to lose track of payment due dates. Unlike a consolidated credit card statement, you’ll have to check each retailer’s site or app for amounts owed and due dates. Missing payments becomes more likely.

Stay organized by keeping a spreadsheet of all open BNPL balances and payment dates. Set reminders for each payment to avoid becoming overdue. Consolidate plans when possible.

Debt Can Snowball

While BNPL is interest-free if paid on time, falling behind on payments leads to expensive late fees, potential credit damage, and snowballing debt. It becomes harder to keep track of payments as more plans are opened, increasing likelihood of default.

Have an exit strategy for each plan and timeline for paying off the balance. Don’t take on too many plans at once and avoid using BNPL if you already have other debts.

Tips for Using BNPL Services Responsibly

BNPL plans can be helpful in some situations when used intentionally, but they aren’t beneficial for everyone. Here are some tips for minimizing risks if you choose to use BNPL services:

- Treat payments like regular bills and budget for them. Don’t take on more plans than you can afford monthly.

- Have an exit strategy for paying off each plan early if possible. Don’t continually open new plans.

- Only use BNPL for planned, non-impulse purchases. Avoid “I’ll just pay later” mindset.

- Track plans in a spreadsheet and set payment reminders to avoid late fees.

- Make payments on time to avoid credit damage. Missed payments are reported.

- Read terms carefully – know late fees, repayment terms, credit impacts.

- Don’t over-rely on BNPL long-term. Build savings and budgeting skills.

- Consider consolidating plans when able into a personal loan to simplify tracking.

- Use BNPL as a last resort. Save up if possible instead of financing purchases.

The Bottom Line

BNPL services like Klarna, Afterpay, and Affirm provide a convenient and accessible way to finance purchases interest-free over time. However, consumers should weigh the risks carefully before opting in.

The ease of BNPL plans can promote overspending and a lack of financial discipline. Missed payments also result in high fees and potential credit damage. But when used sparingly for planned purchases, BNPL can be a helpful budgeting tool for some shoppers.

Understanding both the pros and cons allows consumers to make informed decisions about whether BNPL plans align with their financial situation and spending habits. Avoiding impulse usage and staying organized with payment tracking is key to using these services responsibly.

Leave a Reply