As the world moves toward instant gratification and seamless transactions, Apple’s Buy Now Pay Later (BNPL) service, Apple Pay Later, has emerged as a tempting alternative to traditional personal loans. But, “is Apple’s Buy Now Pay Later worth it” in 2023? In this comprehensive guide, we will explore the ins and outs of Apple Pay Later, discuss its benefits and potential drawbacks, and compare it to other popular BNPL services. By the end, you’ll have a clear understanding of whether Apple Pay Later is the right choice for you.

Key Takeaways

- Apple Pay Later is a convenient Buy Now Pay Later service with interest-free payments, no late fees and minimal impact on credit scores.

- It offers limited loan amounts of up to $1,000 with single payment plans and integration into Apple Wallet for an easy user experience.

- Responsible use requires budgeting & tracking spending, setting reminders for upcoming due dates & regularly checking the account for any potential issues.

Understanding Apple Pay Later

Apple Pay Later is a Buy Now Pay Later service that offers numerous advantages, including:

- Splitting purchases into interest-free installments

- Soft credit check

- Integration with Apple Wallet

- No late fees

- Minimal impact on credit scores

- Seamless compatibility with Apple Wallet

However, potential drawbacks include limited loan amounts, in-store usage restrictions, and the risk of overspending and accumulating debt.

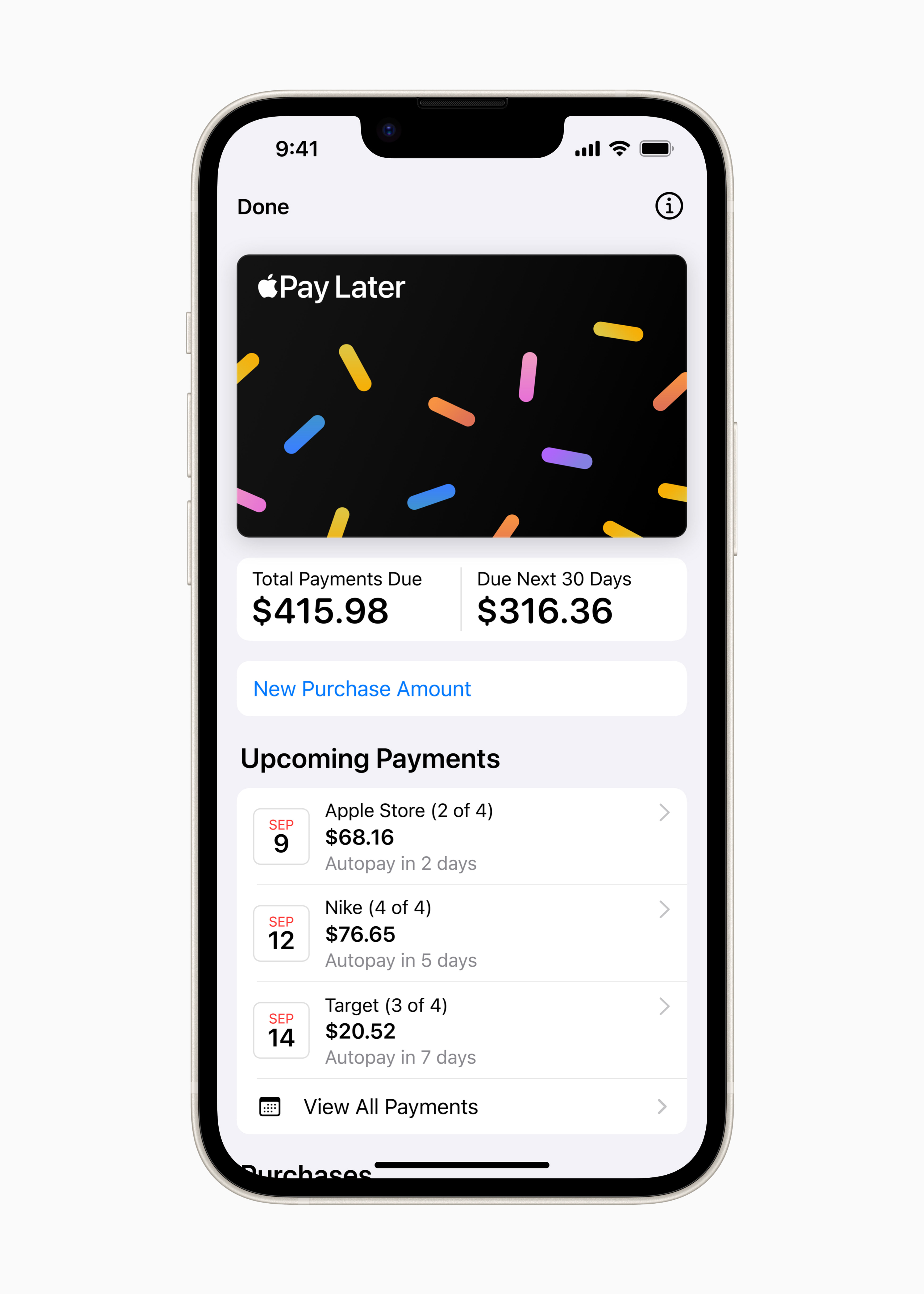

How Apple Pay Later functions

When using Apple Pay Later, payments are divided into four equal payments spread over a six-week period, with the initial payment made at checkout and the remaining three payments made every two weeks. The approval process for Apple Pay Later is based on three criteria:

- A review of the individual’s credit report.

- Details about the purchase made by them.

- Any prior payment history that the consumer had with Apple Pay, including their very first payment.

Apple Pay Later allows users to make both online and in-app purchases. This facility is applicable only for those merchants who accept Apple Pay. This flexibility allows users to finance a wide range of purchases, from everyday essentials to the latest tech gadgets, all within the Apple ecosystem.

Eligibility for Apple Pay Later

Eligible users for Apple Pay Later must meet the following criteria:

- Be at least 18 years old

- Own a compatible Apple device

- Pass a soft credit check

- Have a payment method compatible with Apple Pay

The soft credit pull performed by Apple, which involves credit bureaus, has minimal influence on credit scores and does not necessitate a minimum score for approval.

For utilizing Apple Pay Later, updating your iPhone or iPad to the latest iOS or iPadOS, setting up two-factor authentication, and linking a valid debit card account are necessary. With these requirements met, you can take advantage of the interest-free payments and no late fees offered by Apple Pay Later.

Evaluating the Benefits of Apple Pay Later

Apple Pay Later offers several benefits that make it an attractive option for Apple users, especially when compared to other BNPL services. Among these are interest-free payments and no late fees, a soft credit check with minimal impact on credit scores, and seamless integration with Apple Wallet.

A detailed examination of these advantages will highlight why Apple Pay Later is a standout option.

Interest-free payments and no late fees

One of the most appealing aspects of Apple Pay Later is the ability to make interest-free payments, which means you won’t be paying extra for the convenience of spreading out your payments. Furthermore, Apple Pay Later does not charge late fees, which can save you from additional financial strain if you happen to miss a payment.

While interest-free payments and no late fees are undoubtedly beneficial, it’s essential to acknowledge the potential disadvantages and practice responsible borrowing decisions. By budgeting and monitoring your spending, you can ensure that you utilize Apple Pay Later in a way that complements your financial goals without causing unnecessary stress.

Soft credit check and minimal impact on credit score

Apple Pay Later conducts a soft credit check when you apply for the service, which doesn’t affect your credit score. This is particularly appealing for individuals who are concerned about the potential impact of multiple hard credit inquiries on their credit report. Moreover, there is no minimum credit score requirement for approval, making Apple Pay Later accessible to a wider range of users.

The benefits of using Apple Pay Later include:

- Minimal impact on credit scores

- Faster and smoother approval process compared to traditional loans

- Attractive alternative for short-term financing without the usual hassle and credit implications associated with conventional personal loans.

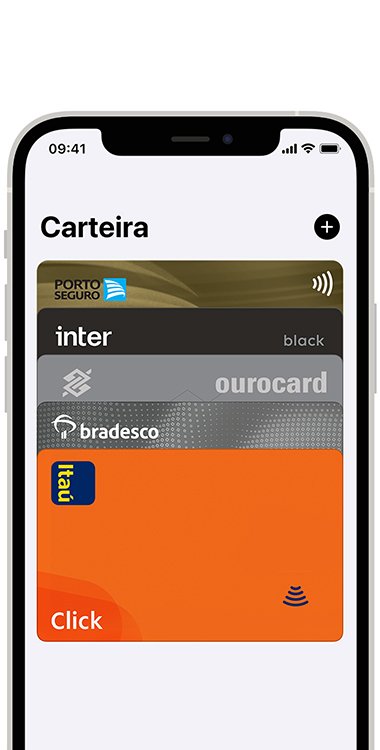

Integration with Apple Wallet

Apple Pay Later is seamlessly integrated into Apple Wallet, providing a convenient and user-friendly experience. This integration allows you to access your payment plans, track your spending, and make payments directly through the Apple Wallet app, making it easy to manage your BNPL loans alongside your other financial activities.

However, it’s important to note that Apple Pay Later’s in-store usage is limited, as the service is not available for all in-store purchases. This restriction may impact your decision to use Apple Pay Later if you frequently shop in brick-and-mortar stores.

Despite this limitation, the seamless integration with Apple Wallet and the convenience it offers still make Apple Pay Later an attractive option for many users.

Potential Drawbacks of Apple Pay Later

Despite the numerous benefits of Apple Pay Later, one should also consider its potential disadvantages such as limited loan amounts, restrictions on in-store usage, and the danger of overspending leading to debt accumulation.

Comprehending these constraints and exercising responsible usage can maximize the benefits of Apple Pay Later while reducing potential risks.

Limited loan amounts and single payment plan

Apple Pay Later offers loan amounts ranging from $50 to $1,000 through its apple pay later loan service, which may not be suitable for larger purchases or individuals requiring more flexible financing options. Moreover, the service only provides a single payment plan, unlike some competitors that offer multiple plans with varying terms and conditions.

While these limitations may be a deal-breaker for some, Apple Pay Later’s interest-free payments and no late fees still make it an attractive loan repayment method for short-term financing, especially for those who only need a small loan or prefer the simplicity of an equal payments spread in a single payment plan.

In-store usage restrictions

Apple Pay Later’s in-store usage restrictions may limit its applicability for certain purchases, as the service is not available for all in-store transactions. This limitation is primarily due to the service being designed for online and in-app purchases where merchants accept Apple Pay.

Despite these restrictions, Apple Pay Later still offers a convenient and flexible financing solution for many users. By understanding the limitations and using the service responsibly, you can still enjoy the benefits of Apple Pay Later while avoiding potential pitfalls.

Risks of overspending and accumulating debt

One of the potential risks associated with using BNPL services like Apple Pay Later is the temptation to overspend and accumulate debt. The convenience and ease of making purchases through Apple Pay Later can encourage impulse buying, which may lead to financial strain if not managed responsibly.

To minimize the risk of overspending and accumulating debt, it’s essential to create a budget, monitor your spending, and be mindful of your financial limits. By doing so, you can enjoy the convenience and flexibility of Apple Pay Later without compromising your financial well-being.

Comparing Apple Pay Later to Other BNPL Services

Having gained an extensive understanding of Apple Pay Later, it’s time to draw comparisons with other popular BNPL services like Affirm and Afterpay.

In this comparison, we will focus on key differences in:

- Fees

- Interest rates

- Payment plans

- User experience

This will help you determine which service best aligns with your financial needs and preferences.

Key differences in fees, interest rates, and payment plans

One of the main differences between Apple Pay Later and other BNPL services is its interest-free payments and lack of late fees. In contrast, services like Klarna and Afterpay may charge late fees or service fees when utilizing a one-time card. Additionally, Apple Pay Later does not incur any interest, whereas other BNPL services may impose interest rates up to 25%.

When it comes to payment plans, Apple Pay Later offers a single payment plan, while other BNPL services may provide multiple payment plans with varying terms and conditions. This difference may be an essential factor to consider when choosing a BNPL service, as individuals with varying financial needs may prefer more flexible payment options.

User experience and app integration

In terms of user experience, Apple Pay Later offers a seamless and intuitive experience with its integration into Apple Wallet. This allows users to manage their BNPL loans alongside other financial activities within the familiar Apple ecosystem, making it easy to keep track of payments and spending.

However, the scope of Apple Pay Later’s availability may be limited compared to other BNPL services, particularly in terms of in-store usage. While other BNPL services may be available in more locations, the convenience and user-friendly experience offered by Apple Pay Later still make it an attractive option for many Apple users.

Ultimately, the best BNPL service for you will depend on your individual needs, preferences, and financial situation.

Responsible Use of Apple Pay Later

To maximize the benefits and dodge potential pitfalls of Apple Pay Later, responsible usage of the service is vital. This means:

- Budgeting and tracking your spending

- Ensuring you can afford the installments

- Avoiding missed payments to prevent any negative impact on your credit score.

We should delve into some strategies that might assist in responsible use of Apple Pay Later.

Budgeting and tracking spending

Creating a budget and tracking your spending is essential when using Apple Pay Later or any BNPL service. A budget helps you determine how much money you can comfortably allocate to your Apple Pay Later installments without causing financial strain.

By monitoring your spending, you can ensure that you’re staying within your budget and not taking on more debt than you can handle.

There are several tools and resources available to help you track your spending with Apple Pay Later, such as budgeting apps, spending alerts, and spending summaries. By utilizing these tools and maintaining a disciplined approach to your finances, you can ensure responsible use of Apple Pay Later and enjoy its benefits without compromising your financial well-being.

Avoiding missed payments and potential credit impact

Timely payments are crucial when using Apple Pay Later, as missed payments can have a detrimental effect on your credit score, even though the service does not charge late fees. To avoid missed payments, consider setting up reminders or notifications on your phone or calendar app to alert you of upcoming payment due dates.

Connecting a debit card to your Apple Pay Later account can also facilitate effortless and automatic payment processing, ensuring that payments are made punctually and preventing any potential credit impact. By regularly checking your Apple Pay Later account and ensuring that all payments are being processed correctly, you can detect any potential issues early on and avoid negative consequences on your credit score.

Summary

In conclusion, Apple Pay Later offers a convenient and flexible BNPL solution that can be an attractive option for many Apple users. However, it’s essential to be aware of the potential drawbacks and limitations of the service, and practice responsible usage to ensure that you’re making the most of its benefits without compromising your financial well-being. By understanding the ins and outs of Apple Pay Later, comparing it to other BNPL services, and employing strategies for responsible usage, you can enjoy the convenience and flexibility of this innovative payment option while maintaining a healthy financial future.

Frequently Asked Questions

Is Apple Pay later worth it?

Apple Pay Later is a great option for those who need to spread out the cost of a purchase over multiple installments with no interest or fees. However, it’s important to be mindful of your spending and only use BNPL for necessary purchases that you can afford in six weeks.

Does Apple Pay pay later affect credit?

Apple Pay Later is not a credit card and using it may result in late payment fees, as well as damage to your credit score if you default on the loan. However, applying for an Apple Pay Later loan won’t have any impact on your credit score, and if payments are made on time, the loan will be reported to credit bureaus and positively affect your credit.

What is the catch with buy now, pay later?

With buy now, pay later, you’re essentially taking out a loan with interest rates and fees that may be exorbitant. Missed payments can incur hefty charges, so it’s important to carefully weigh the costs of BNPL before using this form of financing. BNPL can be a great way to spread out the cost of a purchase, but it’s important to understand the terms and conditions of the loan before signing up. Make sure you know the interest rate, fees,

How does Apple Pay Later compare to other BNPL services?

Apple Pay Later offers users an attractive interest-free payment plan, no late fees, and easy integration with Apple Wallet. However, it may have fewer payment plan options than other BNPL services such as Affirm or Afterpay.

What are the potential drawbacks of using Apple Pay Later?

Potential drawbacks of using Apple Pay Later include limited loan amounts, in-store usage restrictions, and the risk of accumulating debt due to overspending.

Leave a Reply