Picture this: you’re sitting on your couch, browsing your favorite online store, ready to purchase. But suddenly, you hesitate. Is it safe? Will my financial information be secure? Enter Affirm virtual card, the digital payment solution that puts your mind at ease.

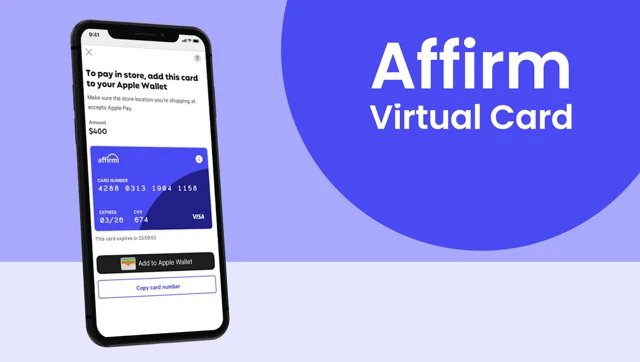

Affirm virtual card is designed for convenient and secure online shopping. With just a few clicks, you can generate a unique virtual card number that can be used for your online transactions. This means you no longer have to share your actual credit card details with multiple merchants, reducing the risk of fraud and unauthorized charges.

But that’s not all – Affirm virtual card offers flexibility and control over purchases. You can set spending limits and expiration dates for each virtual card, ensuring you stay within budget and avoid unwanted surprises.

Say goodbye to worries about online shopping security and hello to seamless transactions with the Affirm virtual card. It’s time to shop with confidence!

Benefits of using Affirm Virtual Card

No annual fees or hidden charges

One of the major benefits of using the Affirm Virtual Card is that it doesn’t come with any annual fees or hidden charges. Unlike traditional credit cards that often have hidden costs, the Affirm Virtual Card allows you to make purchases without worrying about additional expenses eating into your budget. With no annual fees, you can enjoy the convenience and flexibility of a virtual card without any extra financial burden.

Earn rewards on eligible purchases.

Another advantage of using the Affirm Virtual Card is earning rewards on eligible purchases. By using this virtual card for your everyday expenses, you can accumulate points or cashback rewards that can be redeemed for various benefits. Whether it’s earning airline miles, cashback on groceries, or discounts on online shopping, the rewards program associated with the Affirm Virtual Card offers an added incentive for using this payment method.

Enhanced security with virtual card numbers

Security is always a concern. The Affirm Virtual Card addresses this issue by providing enhanced security through virtual card numbers. Instead of using your actual credit card number when making online purchases, you are assigned a unique virtual card number for each transaction. This adds an extra layer of protection against potential fraud or unauthorized use of your credit card information.

With these virtual card numbers, even if they were to fall into the wrong hands, they would be useless for any other transaction outside the specific purchase they were generated. This feature provides peace of mind when shopping online and minimizes the risk of sharing sensitive financial information over the Internet.

In addition to these key benefits, there are other advantages to consider when using the Affirm Virtual Card. For instance:

- Flexibility: The Affirm Virtual Card can be used at online merchants and retailers.

- Easy management: You can conveniently track your transactions and manage your virtual card through the Affirm mobile app or website.

- Budget-friendly: With no annual fees and the ability to set spending limits, the Affirm Virtual Card helps you stay within your budget.

How to apply for an Affirm Virtual Card

Applying for an Affirm Virtual Card is a breeze! The process is quick and won’t impact your credit score when checking eligibility. Let’s dive into the steps to get you started on your way to enjoying all the benefits of an Affirm Virtual Card.

Simple Online Application Process

To apply for an Affirm Virtual Card, all you need is access to the internet and a few minutes of your time. Here’s how it works:

- Visit the Affirm website or app: Head to the official website or download their user-friendly app from your device’s app store.

- Create an account: If you don’t already have one, create a new account with Affirm by providing some basic personal information like your name, email address, and phone number.

- Check eligibility: Once you’ve created your account, you can check if you’re eligible for an Affirm Virtual Card without any impact on your credit score. This step ensures that you can explore this option without any worries.

- Complete the application: If you’re eligible, provide additional details such as your social security number and date of birth. Rest assured that this information is securely encrypted to protect your privacy.

- Link a bank account: To use an Affirm Virtual Card, you must link it to a valid one. This allows for seamless transactions and easy repayment options.

- Review and submit: Take a moment to review all the information provided before submitting your application. Double-check that everything is accurate and up-to-date.

Quick Approval Decision Within Minutes

One of the great advantages of applying for an Affirm Virtual Card is the speedy approval process. Unlike traditional credit cards that may take days or even weeks for approval decisions, with Affirm, you’ll know within minutes whether your application has been approved. This means you can start using your virtual card almost instantly!

No Impact on Your Credit Score When Checking Eligibility

One concern many people have when applying for financial products is the potential impact on their credit score. With Affirm, checking your eligibility for a Virtual Card does not affect your credit score at all. So, you can explore this option without worrying about any negative consequences.

Step-by-step guide on getting started

To get started with an Affirm Virtual Card, follow these simple steps:

Download the Affirm app

The first step is downloading the Affirm app from Google Play or the App Store. Simply search for “Affirm” and look for the official app developed by Affirm Inc.

Sign up for an account.

Once you have downloaded the app, it’s time to sign up for an account. Open the app and click on the “Sign Up” button. Fill in your personal information, including your name, email address, and phone number. Create a strong password that you can remember easily, but others cannot guess.

Link your bank account or debit card.

After signing up, you must link your bank account or debit card to fund your virtual card. This step ensures that you have funds available to make purchases using your virtual card. To link your bank account, select the option within the app and follow the instructions provided. You may need to provide additional information, such as your bank’s routing and account numbers.

If you prefer to use a debit card instead of linking a bank account, choose that option within the app and enter your card details accordingly. Ensure you have sufficient funds in your linked debit card before making any purchases with your virtual card.

By following these three simple steps—downloading the Affirm app, signing up for an account, and linking a bank account or debit card—you will be well on your way to using an Affirm Virtual Card for convenient online shopping.

Using an Affirm Virtual Card offers several advantages:

- Flexibility: With an Affirm Virtual Card, you can purchase at any online store that accepts Mastercard.

- Security: Your personal information is protected when using a virtual card since it doesn’t require sharing sensitive details like credit card numbers.

- Budgeting: The virtual card allows you to set spending limits and manage your budget effectively.

- Rewards: Some Affirm Virtual Cards offer cashback or rewards programs, allowing you to earn benefits with your purchases.

However, there are a few things to keep in mind:

- Availability: Using an Affirm Virtual Card is currently limited to customers in the United States.

- Fees: Be aware of any fees associated with using the virtual card, such as foreign transaction fees or monthly maintenance fees. Review the terms and conditions before proceeding.

Understanding the difference between physical and virtual cards

By understanding their differences, you can choose which type of card suits your needs best.

Physical cards are for in-store purchases, while virtual cards are for online use only

Physical cards, like the ones you may have in your wallet right now, are designed for in-person transactions at brick-and-mortar stores. These cards can be swiped or inserted into card readers, allowing you to make purchases conveniently.

On the other hand, virtual cards are specifically intended for online use. They exist solely in a digital format and don’t have a physical presence. When shopping online, you can enter the unique card number associated with your virtual card during checkout.

Virtual cards provide added security through unique card numbers.

One significant advantage of using a virtual card is its added security layer. Each time you make an online transaction with a virtual card, a unique card number is generated specifically for that purchase. This means that even if someone obtains your virtual card details, they won’t be able to use them again since each transaction requires different numbers.

This feature helps protect against fraudulent activities and unauthorized charges on your account. Knowing that your financial information is less likely to be compromised when making online purchases gives you peace of mind.

Instant availability versus shipping wait times

There’s often a waiting period involved. After applying for one, you may need to wait several days or even weeks before receiving it in the mail. This can be inconvenient if you need to make immediate purchases or want access to funds quickly.

Virtual cards offer instant availability upon approval. Once the issuer approves your application – which can sometimes happen within minutes – you’ll receive all the necessary details electronically. This means you can start using your virtual card immediately for online transactions without waiting for it to arrive in the mail.

Exploring the features of the Affirm Virtual Card

The Affirm Virtual Card offers a range of features that make it a convenient and secure payment option. Let’s dive into some of its key functionalities:

Set Spending Limits and Budgeting Controls

With the Affirm Virtual Card, you can set spending limits and budgeting controls. This means you can decide how much money you want to allocate for your purchases, helping you stay within your financial boundaries. Whether you’re trying to save up or simply want to keep track of your expenses, this feature allows you to take control of your spending habits.

Access Real-Time Transaction History and Purchase Details in the App

One of the advantages of using the Affirm Virtual Card is that you can access real-time transaction history and purchase details directly in the app. This means no more digging through piles of receipts or waiting for monthly statements to arrive in the mail. You can easily view all your transactions anytime, giving you a clear overview of where your money is going.

Enjoy Exclusive Discounts and Offers from Partner Merchants

Another perk of using the Affirm Virtual Card is gaining access to exclusive discounts and offers from partner merchants. These special deals are designed to help you save money on your purchases, making it even more enticing to use this virtual card for your shopping needs. You can stretch your budget further by taking advantage of these discounts while enjoying great products or services.

Having tools that provide transparency and flexibility is crucial. The Affirm Virtual Card offers just that with its spending limit settings, real-time transaction history access, and exclusive merchant offers.

By setting spending limits and budgeting controls with this virtual card, you can ensure that overspending doesn’t become an issue. Knowing that you won’t go overboard with impulse purchases or exceed your budgetary constraints gives you peace of mind.

Accessing real-time transaction history and purchase details directly within the app is a game-changer. You can easily keep track of your expenses, making it easier to identify areas where you may need to cut back or adjust your spending habits.

Moreover, the exclusive discounts and offers from partner merchants are a bonus. These perks provide an opportunity for significant savings on purchases you were already planning to make. Whether it’s a discount on clothing, electronics, or even travel, these offers can help you get more value out of your money.

Tips for effective use of the Affirm Card

Pay Off Balances on Time to Avoid Interest Charges

One of the most important tips for effectively using the Affirm Virtual Card is to pay off your balances on time. Doing so can avoid interest charges and keep your finances in good shape. Late payments can lead to hefty fees and increased interest rates, which can quickly add up and strain your budget.

To stay on top of your payments, it’s crucial to set reminders or enable notifications that alert you when your payment due date is approaching. This way, you won’t forget to pay and risk unnecessary charges. Consider setting up automatic payments if it aligns with your financial situation. This ensures that your balance is paid off promptly each month without any effort.

Utilize Budgeting Tools to Track Spending Habits Effectively

Another key aspect of effectively utilizing the Affirm Card is keeping track of your spending habits. To do this efficiently, take advantage of budgeting tools available through the Affirm app or other personal finance apps. These tools allow you to categorize expenses, set spending limits, and monitor where your money is going.

By regularly reviewing these budgeting tools, you can gain valuable insights into your spending patterns and identify areas where you may need to cut back or adjust. For example, notice that a significant portion of your budget goes towards dining out or online shopping. You can make conscious decisions to reduce those expenses and allocate funds towards more essential needs or savings goals.

Make Use of Rewards Programs to Maximize Benefits

Maximizing benefits is an excellent strategy when using any credit card, including the Affirm Virtual Card. Take advantage of rewards programs offered by Affirm or affiliated partners to earn cashback or other perks for every purchase made with the card.

Some rewards programs offer higher cashback percentages for specific categories, such as groceries or travel. By understanding the program’s terms and utilizing it strategically, you can earn rewards on your everyday expenses and make your money work for you.

In addition to cashback rewards, some programs may offer exclusive discounts or access to special events. These additional benefits can further enhance your overall experience with the Affirm Card and provide added value beyond just making purchases.

By following these tips – paying off balances on time, utilizing budgeting tools effectively, and using rewards programs – you can make the most out of your Affirm Virtual Card. Remember, responsible credit card usage is key to maintaining a healthy financial situation while enjoying the convenience and benefits offered by the Affirm Card.

The power of Affirm Virtual Card

In conclusion, the Affirm Virtual Card is a game-changer. Its seamless integration and user-friendly features offer a convenient and secure way to make purchases. Not only does it provide the flexibility of splitting payments into manageable installments, but it also gives you the freedom to shop at your favorite online stores without worrying about credit card debt.

So why wait? Take control of your finances and start using the Affirm Virtual Card today. Experience the power of hassle-free shopping with flexible payment options. Don’t miss out on this opportunity to make your online shopping experience smoother than ever before.

FAQs

Can I use the Affirm Virtual Card for in-store purchases?

Currently, the Affirm Virtual Card can only be used for online purchases. It is designed specifically for secure transactions in the digital realm.

Is my personal information safe when using the Affirm Virtual Card?

Absolutely! Affirm takes privacy and security seriously. Your personal information is encrypted and protected against unauthorized access.

Are there any fees associated with using the Affirm Virtual Card?

The Affirm Virtual Card has no hidden fees or annual charges. However, if you split your payments into installments, interest may apply depending on your purchase terms.

Can I use my existing credit card along with the Affirm Virtual Card?

No, the Affirm Virtual Card acts as a standalone payment method. It cannot be combined with other credit cards for a single transaction.

How long does it take to get approved for an Affirm Virtual Card?

The approval process for an Affirm Virtual Card is quick and easy. In most cases, you’ll receive an instant decision upon submission of your application.

Leave a Reply